Connecting your capital with real estate.

Primera+ provides investors with access to a diversified portfolio of midmarket commercial real estate assets.

We provide investors with the opportunity to take part in the commercial real estate market which has been historically restricted due to capital and expertise requirements

We provide the opportunity to take advantage of a gap in the commercial midmarket in Ontario

We aim to improve the operational management and enhance the value of properties in the market

REIT’s are constrained on asset selection and value-add activities, potentially limiting returns; we pursue value creation across our portfolios to enhance returns

Midmarket commercial real estate in Ontario is an attractive investment landscape with unique characteristics. With less competition than other markets, we pursue the untapped opportunity to create above-market rates of return.

Investing in Commercial Real Estate

We are designed to leverage both generational knowledge of the Southwestern Ontario commercial market and our deeply ingrained ties to local business leaders, industry partners and thought leaders, to identify and capitalize on the region’s most lucrative midmarket investment opportunities.

*Primera+ Principals and Management Team successfully manage landmark developments throughout the marketplace.

CRE is an attractive asset class

Opportunity for investment portfolio diversification

Superior risk-adjusted returns

Tangible asset with intrinsic inflation hedge

Ability to deploy large amounts of capital without moving the market

Primera+ solutions provide

Active management and expertise

Specialized knowledge of the asset class and market

High quality, exclusive deal flow through key industry relationships

Portfolio diversification to improve risk-adjusted returns

Ontario is a place of economic opportunity.

Toronto & GTA Industrial Market is the 3rd Largest in North America

Integrated Supply Chains with U.S. Markets

Provincial Population of ~14.7 Million

Toronto is the 2nd Largest Financial Hub in North America

Ontario Generates 40% of National GDP

Why Invest in Southwestern Ontario?

As the province continues its transition to a serviced-based economy, commercial space demand is steadily growing. Despite constant demand, additional supply of new space is limited with minimal change in availability.

Employment lands in Toronto and the GTA are some of the most sought-after in the Western Hemisphere. Excess demand has caused a spillover effect and significant impact on surrounding areas. With Highway 401 access and GTA proximity, Waterloo & Wellington regions, and more specifically, Cambridge and Guelph, have become predominant beneficiary markets.

Traditionally, Waterloo & Wellington regions have been labelled secondary markets, but factors such as housing affordability and less congestion have attracted new businesses, residents, and sophisticated developers/investors. We see a strong future and favourable long-term trends for these markets.

We offer two unique funds with different themes and

risk profiles to suit your financial goals.

Customize your investment strategy with Primera+.

Primera+ Income offers stable cashflow and returns to investors by investing in mature, cash-flowing assets.

Focuses on generating stable cashflows for investors

Focuses on long-term wealth creation

Property focus is on quality and cashflows

Longer term hold profile typically many years

Primera+ Opportunity focuses on distressed and underperforming assets seeking capital appreciation with higher rates of return.

Focuses on capital gains for investors

Focuses on improving properties

Trading position in properties

Shorter term holds; typically 24-60 months

After maturation and performance improvement, asset may be sold to Primera+ Income

Primera+ is proudly Canadian and welcomes participation from the global investor community.

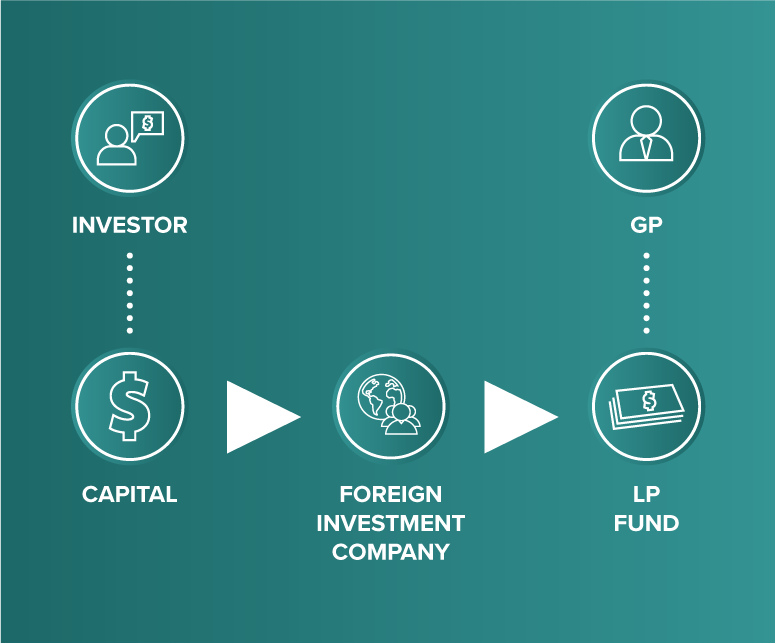

Foreign Investment Structure

It is generally anticipated that foreign investors will invest in a parallel fund to the Canadian investors due to tax and reporting requirements. Participation in underlying assets will be shared according to total capital invested.

Foreign investment in Taxable Canadian Property that gives rise to rental income will require annual tax return compliance to be filed in Canada, but where there are many foreign investors, the use of a common entity for compliance purposes may be explored.

Tax structuring advice for the local jurisdiction should be obtained and will drive much of the planning.

Forward Thinking. Digital First.

Primera+ is a digital-first firm, allowing us to excel in today’s competitive market.

We use digital tools that highlight value, create efficiencies, and maximize your return on investment.